West Virginia Tax Cuts Could Work If Done Properly

Download PDF

A Response to Concerns About the Kansas Tax Plan & West Virginia Tax Cuts

Even before 2021 began, potential West Virginia tax cuts on the personal income tax (PIT) became a lightning rod topic. Governor Justice announced eliminating the state income tax as his top priority. Legislators have also been talking about it in addition to their other major policy priorities this year.

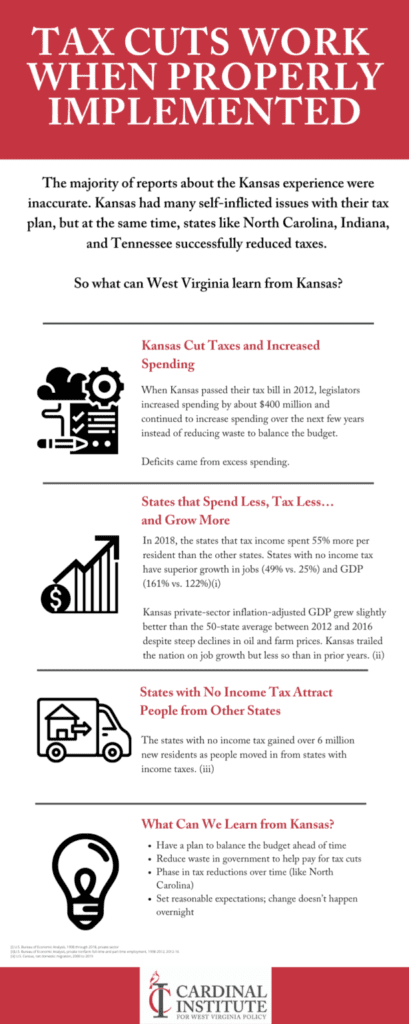

We often hear detractors of tax reform proposals in West Virginia say, “Kansas failed when they cut the income tax, so why should we try that?!”

We Have Answers For You

If you’re confused, and let’s face it, we’d be impressed if you weren’t, we have resources to help!

We have created an infographic with quick facts about this issue to help simplify this complex issue.

Download this infographic if you want a quick primer on how we can create successful tax reform in the Mountain State!

If resources like this are helpful to you, please let us know! We want to make sure the content we create is useful to the average person in West Virginia.

Created by Jessica Dobrinsky, Policy Development Associate for the Cardinal Institute for WV Policy, alongside Jessi Troyan, Cardinal’s Policy & Development Director.

Learn More

*You can learn more about income taxes in West Virginia on the Cardinal’s Nest blog.

*If you want to learn more about the Kansas tax plan, you can read What was Really The Matter with the Kansas Tax Plan by Dave Trabert.

*You can also keep up with the Cardinal Institute on Twitter @CardinalWV.

*Subscribe to our Wild & Wonderful Wednesday newsletter by filling out this contact form and putting NEWSLETTER in the subject line.